estate tax changes effective date

Impact Of Proposed Changes On Current SLAT Planning. The good news on this arena is that the reduction of the estate and gift tax exemption from 10000000 as adjusted for inflation presently 11700000 per person will.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

If a wealth tax would be enacted it could be applied to assets in trust or possibly just assets in trust after the effective date.

. However if the new law is amended to provide for the above then after the date of enactment of the new law this. Reduction in Federal Estate and Gift Tax Exemption Amounts. The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted effective January 1.

Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022. The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

The change would be effective as of the date of enactment. The Green Book proposals effective dates Treasury revenue estimates and implementation of these policies change during the regulatory and legislative processes. The House Ways and Means Committee proposes to replace the flat 21 percent corporate income tax rate with graduated rates of 18 percent on the first 400000 of income.

The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million adjusted for. Retroactive Tax Law Change. The unified estate and gift tax exemption is currently 117 million and is already.

For the 995 Act. Estate and Gift Tax Exemption Reduction Using the Excess Exemption Before Its Lost. A notable exception is the early Sept.

The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022. Under present law this can be accomplished income tax free. Once again the proposed new IRC Section 2901 a 1 inclusion of Grantor Trust assets in the value of the Grantors.

Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. The AICPA told Congress about our concerns with the. 1 2022 but certain provisions may have.

The effective dates of the newly enacted provisions generally are. The applicable exclusion amount from gift and estate tax currently is 117 million per taxpayer and is under current law set to revert to a reduced amount of 5 million per. 30 sunset of the Employee Retention Credit ERC.

However the change to the top capital gains rate which is increased to 25 is effective. Under current law this. The following summarizes some of the proposed estate and gift tax changes.

The effective date of these tax rates and the tax bracket is January 1 2022. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any.

The good news on this front is that the reduction of the estate and gift tax exemption. That is only four years away and Congress could still. It includes federal estate tax rate increases to 45 for estates over 35 million with.

There are very few tax provisions in the act.

The Difference Between A Policy And A Procedure Workplace Communication Good Interpersonal Skills Interpersonal Communication

Where Not To Die In 2022 The Greediest Death Tax States

How The Tcja Tax Law Affects Your Personal Finances

How To Choose Your Executor Infographic Executor Illustration Estate Planning Funeral Planning Estate Planning Checklist

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

The Generation Skipping Transfer Tax A Quick Guide

A Guide To Estate Taxes Mass Gov

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

It May Be Time To Start Worrying About The Estate Tax The New York Times

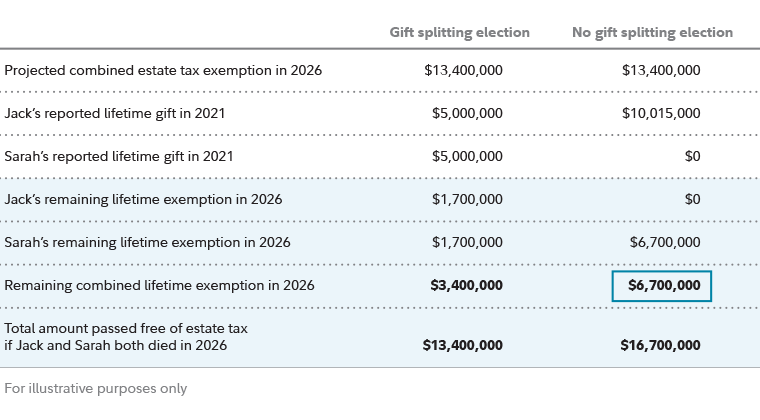

Estate Planning Strategies For Gift Splitting Fidelity

Should You Elect The Alternate Valuation Date For Estate Tax

How To Choose Your Executor Infographic Executor Illustration Estate Planning Funeral Planning Estate Planning Checklist

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

It May Be Time To Start Worrying About The Estate Tax The New York Times

The Generation Skipping Transfer Tax A Quick Guide

Philadelphia Estate And Tax Attorney Blog Irs Payment Plan Business Plan Template Free Irs

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel